The Nkosuo Loan program has been launched by Mastercard Foundation, in partnership with the National Board for Small Scale Industries (NBSSI) as an Emergency Program to support micro, small, and medium-sized enterprises (MSMEs) and start-ups in Ghana who have been affected by the ongoing pandemic. The program which falls under the general NBSSI Mastercard Foundation Recovery and Resilience Program for MSMEs, will provide financial and business advisory support to MSMEs and start-ups to help them weather the economic downturn caused by the COVID-19 pandemic.

The following FAQs seek to help you understand the program and apply successfully:

1. What is NBSSI & Mastercard actually offering ?

Q: What is the NBSSI Mastercard Foundation Recovery and Resilience Program for MSMEs?

The NBSSI Mastercard Foundation Recovery and Resilience Program for MSMEs has been set up to provide financial and business advisory support to MSMEs and start-ups weather the economic downturn caused by the COVID-19 pandemic. It has 2 main components – supporting MSMEs (businesses) and strengthening business support institutions (service providers).

It has an initial commitment of GHS90 million and it is expected to benefit 25,000 MSMEs.

Q: What Types of Small Business Loans Are Available?

The program comes with the Nkosuo Loan program which will provide financial assistance to MSMEs in the form of grants and soft loans. The funds will be disbursed via participating institutions – banks, microfinance, mobile lenders, NGOs. The amount for which a business is eligible will depend on its size and how much revenue it generates.

2. Eligibility for the Nkosuo Loan

Q: Who is eligible for the Nkosuo Loan?

All Ghanaian-owned businesses, registered or unregistered are eligible to apply for funding. The program has a special focus on:

- MSMEs who need support to survive the COVID-19 pandemic.

- Businesses in growth sectors where the employment of young people, especially young women, will be negatively impacted as a result of business operation disruptions, supply chain challenges, liquidity shortages, declining sales and profits, and business closures

- Businesses providing services that will be in demand during the pandemic and that have the potential to grow and positively impact communities affected by COVID-19

- Businesses that will focus on digitization to support MSMEs

Q: Are there other eligibility requirements for the Nkosuo Loan?

Yes, as stated below:

- You must be a Micro, Small and Medium Enterprises (MSMEs) with activities drastically slowed by the COVID-19 pandemic in many ways including

-

- Production and supply chain disruptions, shortages and delays

- Reduced consumer demand for products and services

- Reduced capital and investment flows

- Labor shortages due to social distancing regulations

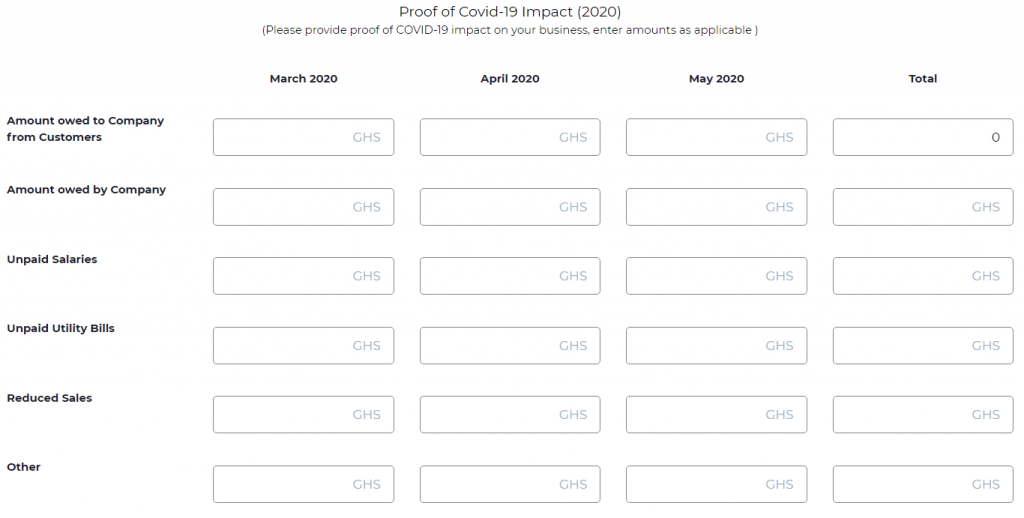

You will be required to fill a form like the one below to show the effect of the pandemic on your business:

- Your services should be in demand during the pandemic and that have capability to grow and positively impact communities affected by the pandemic

- You are in the priority industries (see next question)

- Enterprise must be either a micro, small or medium enterprise. Informal enterprises are also accepted

- Enterprise must be willing and committed to continue maintaining the operation of their business via the accessing of a loan (either with or without the grant) and are unable to avail the required loan collateral

Q: What are the priority industries for the Nkosuo Loan?

Priority industries include:

- Agri and Agro business

- Food & Beverages

- Water & Sanitation

- Services

- Technology

- Manufacturing

- Garments & PPE

- Commerce and Trade

- Logistics

- Hospitality & Tourism

- Healthcare & Pharmaceuticals

- Education

Q: What Businesses/Institutions Are Excluded?

The following are excluded from the program:

- A beneficiary to the Government of Ghana CAP Business Support Scheme (i.e. a business that has received funds from that program) cannot apply to for funding from the NBSSI Mastercard Foundation COVID-19 Resilience and Recovery Program.

- There should be no funding of partisan political activities

- Businesses cannot be those that do not meet basic social, environmental and governance compliance criteria such as

- Alcohol

- Tobacco & Drug-related businesses

- Weapons Manufacture & War-related Activities

- Gambling/betting

- Sex-related industries

- Ownership by state or parastatal actors; for manufacturing, EPA-regulation compliance

- New businesses or businesses that are less than 6 months old at the date of application

NB: If two or more businesses have the same owner only one of those businesses may apply under this fund.

3. Loan/Grant Details under the Nkosuo Loan Program

Q: How Much Can an Applicant Receive under the Nkosuo Loan?

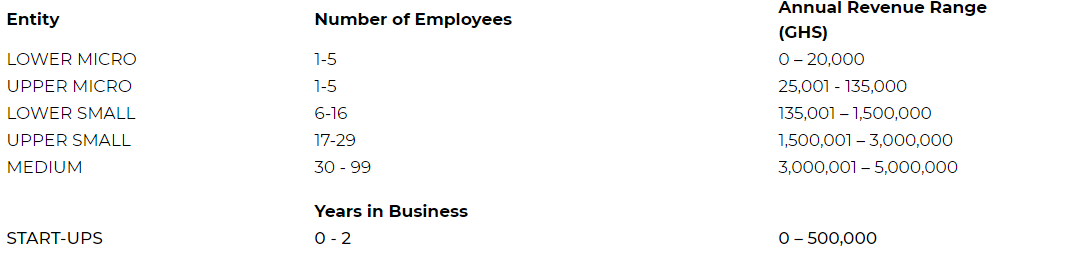

The amount for which a business is eligible will depend on its size and how much revenue it generates. Businesses will be categorized as Micro, Small, Medium Enterprise or a Start-Up:

Q: Are There any Collateral or Personal Guarantee Requirements?

No. You do not need any collateral to apply.

Q: What Are the Allowed Uses of the Loans?

Not explicitly stated by NBSSI. However, like other emergency funds, we think you can use it for:

- Procurement of raw materials for immediate use

- General operational and administrative expenses – rent, salaries, utilities etc

- Any other need of the MSMEs that positively impacts the business and retain human resource

Q: What Are the Restrictions on Use of the Loans?

The restrictions include the following:

- You cannot take loan to start a new business

- You cannot apply twice for the loan. For an applicant with more than one business, only one qualifies to access the loan

Q: What Are the Fees and Interest Rates on the Nkosuo Loan?

Not explicitly stated for now. We will update when we get more info on it

Q: What Are the Repayment Considerations?

Repayment of the loan is arranged as follows:

- Moratorium: up to 1 year moratorium

- Repayment period: 2 years repayment period

4. Process/Procedure for applying for the Nkosuo Loan

Q: Who Will Be Given Priority?

Priority will be given to

- Female-owned businesses are encouraged to apply

- Youth-owned or youth-led businesses (age 18-35) are encouraged to apply

Q: How do I receive the loan when approved?

Participating institutions in charge of lending/disbursing loans will be nominated by NBSSI. These include Opportunity International and Rural Banks. This means when your application is approved, your funds will only be disbursed via bank account, financial institutions selected, or mobile money transfer. You do not need to go to any NBSSI centres or offices for physical cash.

Q: How Can I Apply?

The application process is as follows:

- Complete Application Form at https://ghrecoveryprogram.com/apply

-

Application Review: Upon completion of your funding application, you will be shown a Review Page. Thoroughly review all your inputted information before hitting submit. This will enable us to serve you as quickly as possible

-

Receive Funds: Upon submission, our team will review your application. Once everything is satisfactory, you can expect to receive your funds in the mobile wallet or bank account you selected within 2 weeks. Sit tight while we work for you.

You can also call the NBSSI Helpline on 030 274 7777 ; or visit the nearest NBSSI district office (Business Advisory Centre) for help

Q: When can I apply & when is the deadline?

Businesses can start applying from September 16th 2020 and will continue for 1 month or until the funds run out. The final application closing date will depend on the number of applicants and amounts requested. All financing requests are expected to be disbursed, and the application process to be closed by the end of October 2020 or when the funds run out.

Q: What supporting documents & info do I need to apply for this loan?

- Your TIN

- Proof of business operations

- Description of Business (i.e type personnel, customer, suppliers etc.)

- Financial details (i.e Sales, cash flow statement, profit & loss extract). You do not need to have these documents (audited statement) prepared by an accountant.

- Detail of product and services

- Demonstrate that COVID-19 had had negative impact on your business

Q: Who do I contact for more information on this loan?

Applicants seeking further clarification can call the NBSSI Call Centre on 0302 747 777.

Leave a Reply