The Ghana Revenue Authority has imposed a special levy known as the COVID-19 Health Recovery Levy which is to be implemented from May 1, 2021. The levy is a 1% charge on all goods and services that are subject to VAT. This article is to help you setup that on Built Accounting.

VAT Standard:

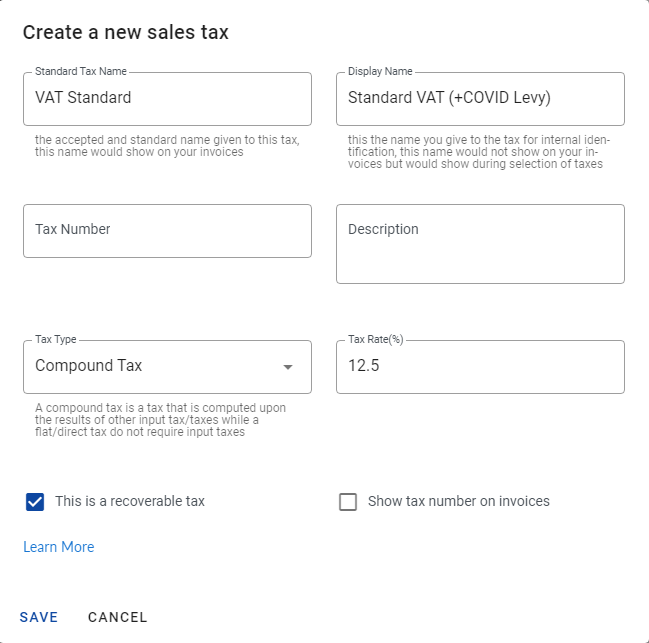

As you are aware, the Standard VAT is a compound tax of 12.5% which is applied after GETFUND (2.5%) and NHIL (2.5%) has been applied on the VAT-exclusive amount. With the introduction of the COVID-19 Levy, VAT (12.5%) will have to be applied on the subtotal obtained from adding COVID-19 Levy (1%), GETFUND (2.5%) and NHIL (2.5%) to the VAT-exclusive amount.

To setup this in Built Accounting:

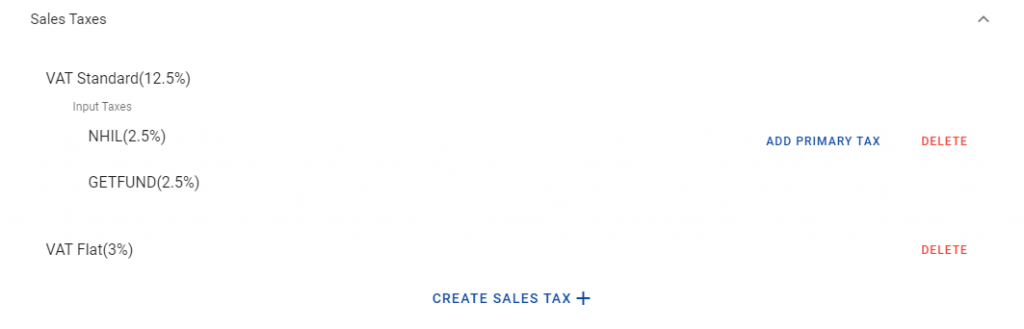

- Go the Settings page of your business and click on Sales Taxes Tab. Now, Click on Create Sales Tax + as shown below

- You will get a pop up which you will have to fill to setup VAT. Fill it like shown below:

- After saving, you will get a screenshot like this, which will then ask you to add Input taxes.

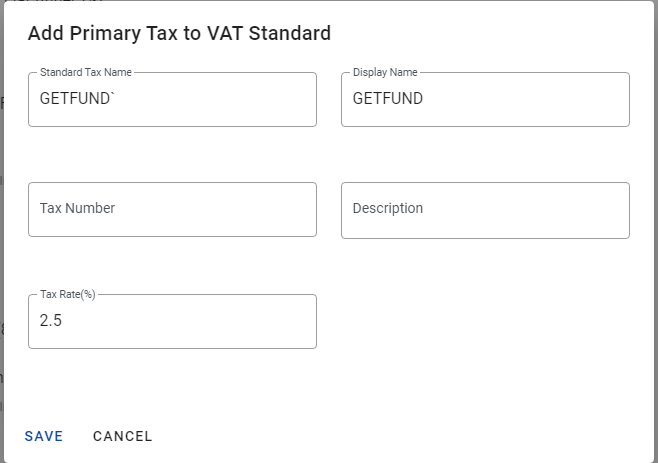

- The input taxes are the GETFUND (2.5%), NHIL (2.5%) and COVID-19 Levy (1%). Input taxes must be added one by one. You can start by entering GETFUND like shown below. When done, do same for NHIL and COVI-19 Levy.

After adding all the input taxes, you will get something like this which shows you have successfully setup the new VAT system in Built Accounting:

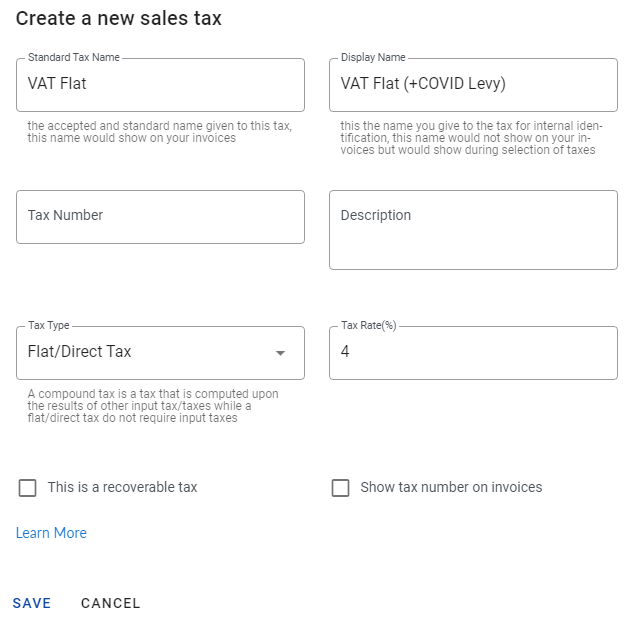

Setting up the new VAT Flat in Built:

This one is pretty straight forward. This is because the rate has just been increased from 3% to 4% so you will just need to setup that in the system.

To do that, click on Create Sales Tax + and fill in the fields exactly as shown below:

Remember to tick off the box for This is a recoverable tax; as it is not.

Also, note that Built Accounting will be sending notifications to businesses that want automatic setup of these taxes in their accounts. When you get that alert, click Apply and these taxes will be automatically setup for you.

Leave a Reply