On the last day of March, the Registrar General’s Department (RGD) and the Ghana Revenue Authority both announced that effective April 1, 2021, the Ghana card Personal Identification Number (Ghana Card PIN) will replace the Taxpayer Identification Number (TIN) of individuals for tax identification purposes.

What this means is that, all transactions that require individual TIN will now be carried out with the Ghana Card PIN. This replacement is not immediate – the authorities are giving a transition period from April 1, 2021 to December 31, 2021 within which both TIN and Ghana Card PIN can be used simultaneously. From January 1, 2022, only the Ghana PIN Card will be used.

What does this mean for you?

This means that you, as a taxpayer, will need to ensure that you have your Ghana Card ready and you get it linked with your TIN. This is particularly important if you operate a sole proprietorship business where you are seen as the business and you do not want this to affect your business operations and engagement with GRA and RGD after the transition period. For instance, filing of tax returns, payment of taxes, clearing of goods, registering and renewal of business can only be done with a Ghana Card PIN.

What if you don’t have your Ghana Card?

GRA has made available officers at the various GRA locations to register you. You just have to walk in with a valid birth certificate, a valid passport or a valid certificate of acquired citizenship. You can also go along with the following documents to be linked to your Ghana Card: SSNIT, DVLA (LICENCE), NHIS, PASSPORT, EC (VOTER CARD)

How to link your Ghana Card PIN with TIN?

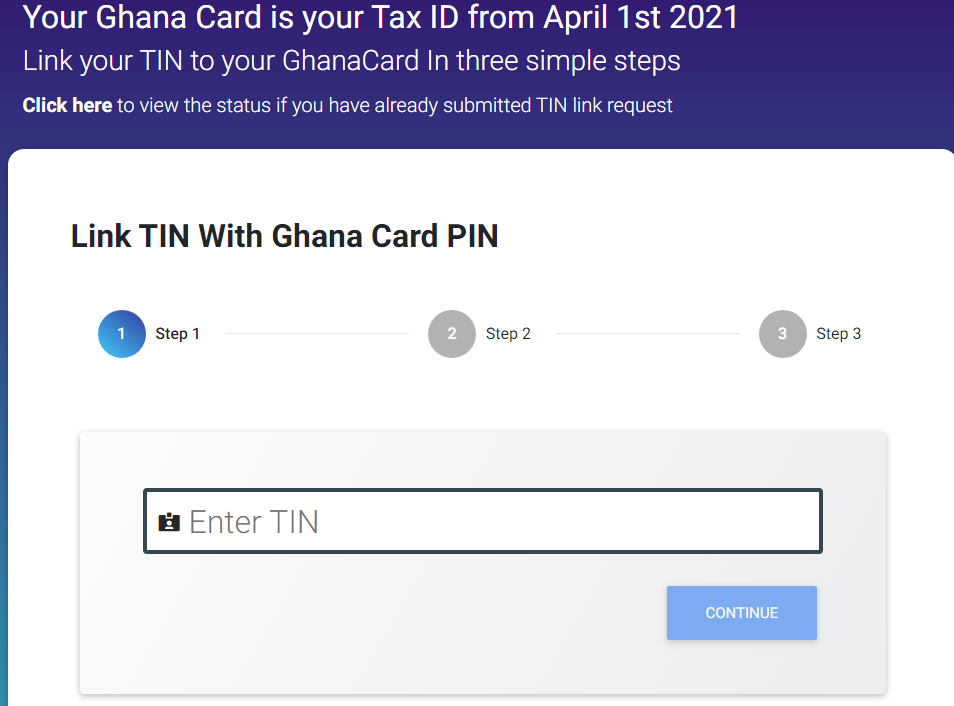

To link your Ghana Card PIN with your TIN, visit https://myid.gra.gov.gh/ and follow the steps below.

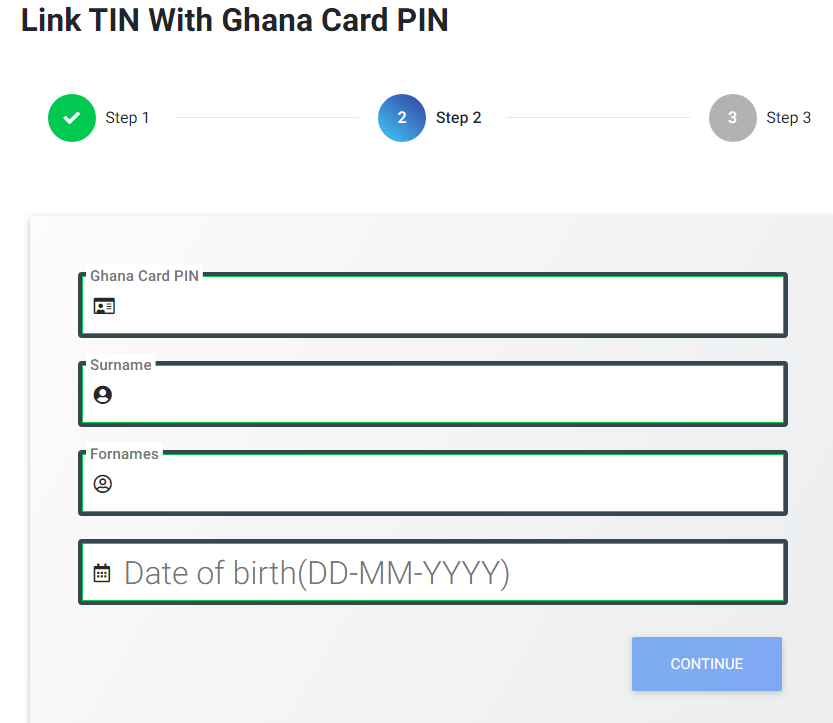

NB: Fill the form step by step. Do not jump one text field as the system tries to verify everything you enter step by step. If you jump a text field, you will not be able to go through step 2.

- Enter your TIN as showed below. Remember we are talking about your personal TIN and it always starts with P followed by 10 characters.

- Enter Your Ghana Card PIN, Surname, Forenames and Date of Birth. Enter them accordingly. Do not jump from, say Surname to Date of Birth. It will not allow you to go through.

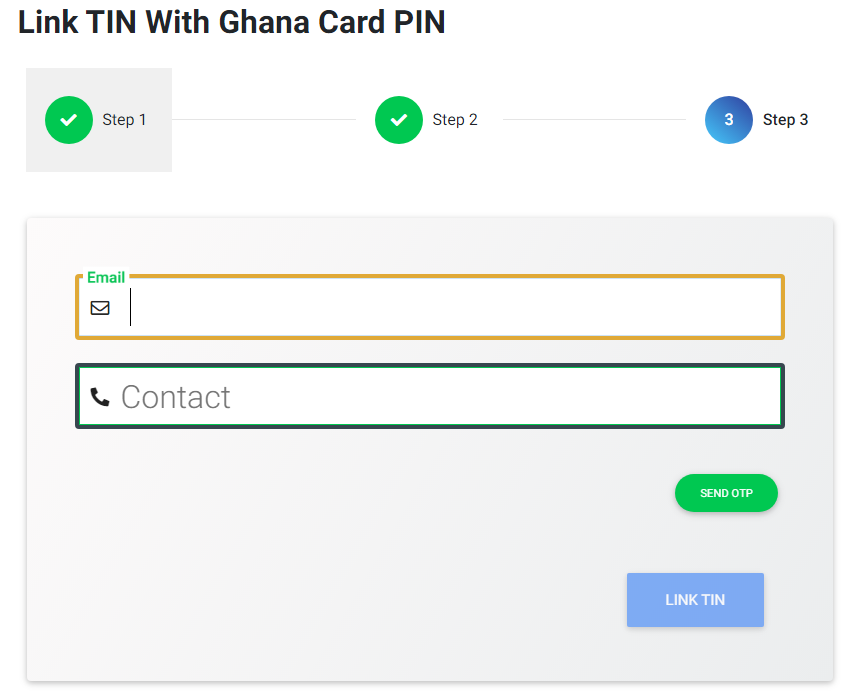

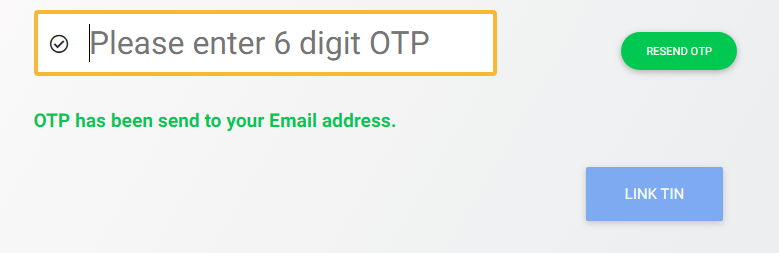

- The final step has to do with you entering your email address and phone number. Ensure that the details you provide are accurate as you will be sent an OTP which is a 6-digit number to finally authorize the linkage.

- Enter your OTP in the space provided and click Link TIN.

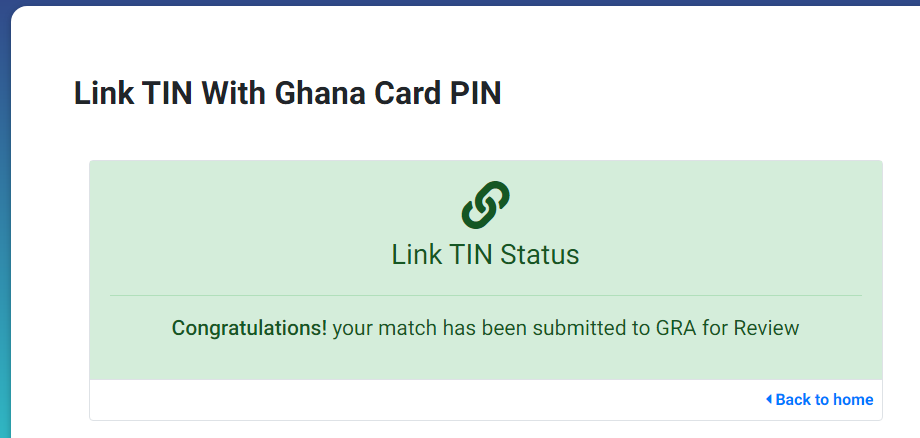

After clicking Link TIN, you will be sent a confirmation like the one below:

Congrats! You have linked your TIN.

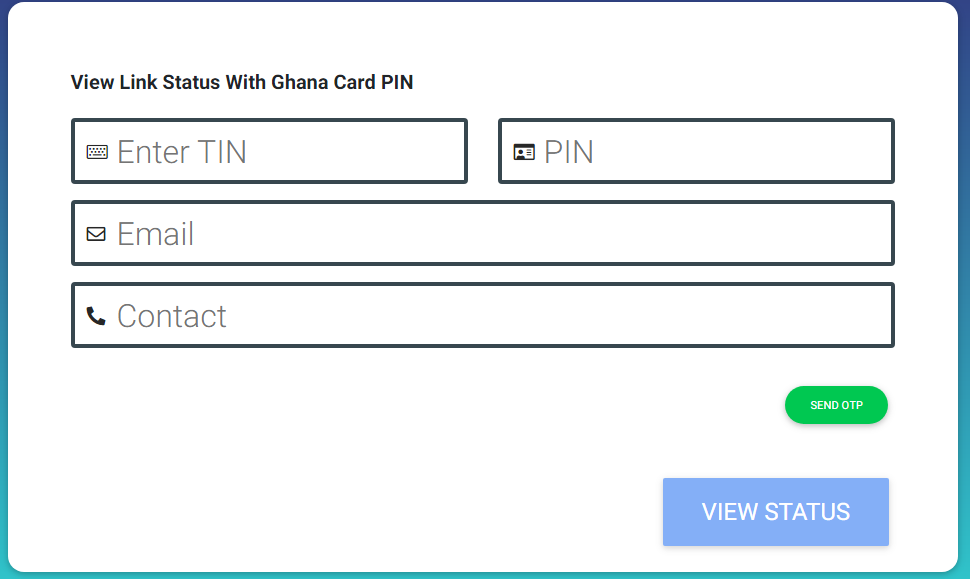

What if I want to confirm if I have linked my TIN appropriately?

You can click https://myid.gra.gov.gh/LinkTinStatus and fill in the form like showed below:

You will be asked to enter your OTP after which you need to click View Status. If it is not linked yet, do not panic. As you can see on the congratulation message, the submission needs to be reviewed by GRA first.

Ghana CardGhana Card PINTIN

Leave a Reply