Last year, the government announced an 11% increment in the national daily minimum wage. By this, minimum wage earners who got GHS10.65/day (GHS288/month) in 2019 will from January this year, receive GHS11.82/day (GHS319/month).

This increment in the minimum wage is a significant activity as it affects businesses in a number of ways (Read: How does the increment in the new minimum wage affect my business?). One is that it sets the floor for tax-free band of an employee’s taxable employment income – meaning any employment income earned up to the minimum wage amount will not be subjected to tax. As a result, whenever there is a change in the minimum wage, the employee income tax, also known as Pay-As-You-Earn changes.

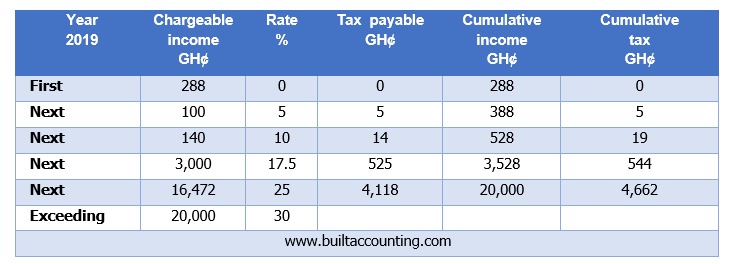

Example 1: Old (2019) PAYE computation:

For instance, as you can see from the table above, in 2019, the amount of one’s taxable employment income that is not subjected to tax is GHS288. At the time, someone earning GHS500 gross basic, will thus end up with the following:

Gross Basic Income: GHS500

SSNIT (Employee contribution): GHS27.50

PAYE: GHS13.45

Take home pay: GHS459.05

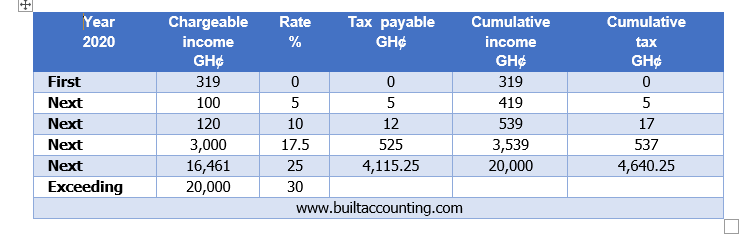

Example 2: New (2020) PAYE computation:

As the table shows, the first band of taxable income that is tax free, same amount being the minimum wage, is GHS319. Using this new schedule and the GHS500 gross basic amount we started with in Example 1, this is what the employee’s payroll figures will look like:

Gross Basic Income: GHS500

SSNIT(Employee contribution): GHS27.50

PAYE: GHS10.35

Take-home pay: GHS462.15

Conclusion

In summary, comparing the two computations above, you will see that the employee’s SSNIT (Employee contribution) remains the same but the income tax (PAYE) reduces from GHS13.45 to 10.35 and the take-home pay increases from GHS GHS459.05 to GHS462.15. This is what minimum wage changes does to the salaries of employees.

We have included a template for the current computation which you can download by click on this link. Moreover, we have created a tax calculator mobile app which you can use to calculate the current PAYE as well as the new VAT in Ghana.

2020 PAYE Template Link

Tax Calculator App Link

income taxminimum wage in ghanaPAYESSNIT in Ghana

[…] wage. A new minimum wage was announced for 2020. Consequently, a new graduated schedule was given. PAYE tax must be paid by the 15th of each ensuing month. Thus, the PAYE tax for May must be paid by 15th […]