As business owners and accounting professionals we work with taxes on a daily basis. Finding a way to simplify how you calculate taxes is one of the holy grail of the accounting profession. For business owners, it is a way of taking away the complexities that certain taxes come with. Thus, it came as no surprise for us to see our article on invoices, How to Invoice with the new VAT system in Ghana, is one of our most read articles on the Builders Blog. Now, let us tell you about our tax calculator ghana mobile app.

In this write-up, I am going to introduce you to a tax calculator app I made with Glide. Glide is a web platform that enables you to turn your speadsheets, specifically Google Sheet, into a mobile app. This mobile app has the current PAYE and VAT tax calculators.

How to install app: First visit https://ohyw0.glideapp.io/

Adding Tax Calculator Ghana to home screen on iOS:

- Tap on the “Share” icon located at the bottom of the page

- Tap the “Add to Home Screen” button

- Tap the “Add” button at the top right corner of the screen

Adding an app to home screen on Android

- Tap on the notification banner at the bottom of the page (alternatively, you can tap the “Add to Home Screen” option inside the menu at the top right corner of the screen)

- Tap the “Add” button on the modal

How to Use Tax Calculator Ghana

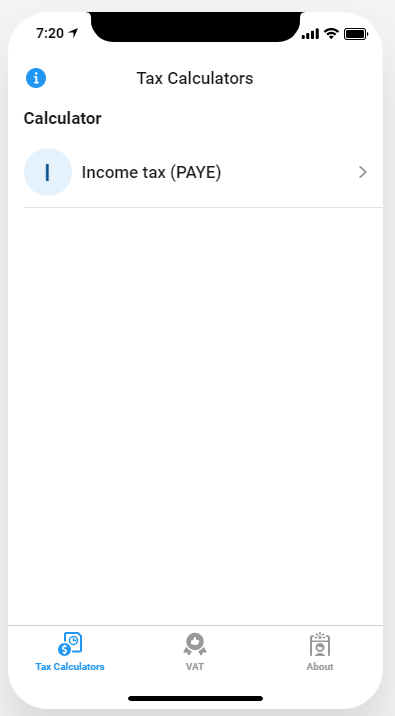

Now that you have install installed the app, you will get this view when you open it.

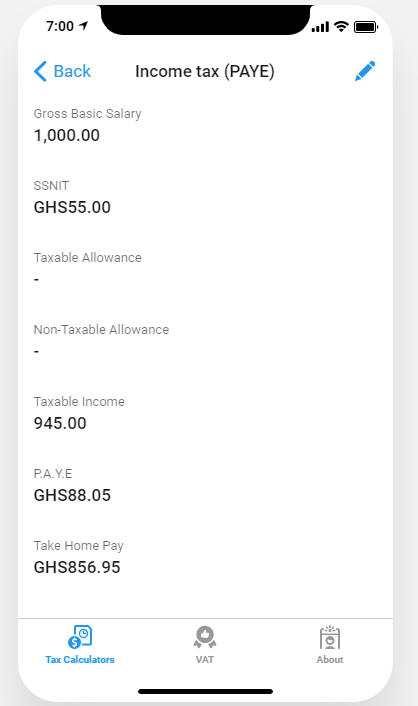

When you click on Income Tax tab, Tax calculator ghana app takes you to a view with sample calculations.

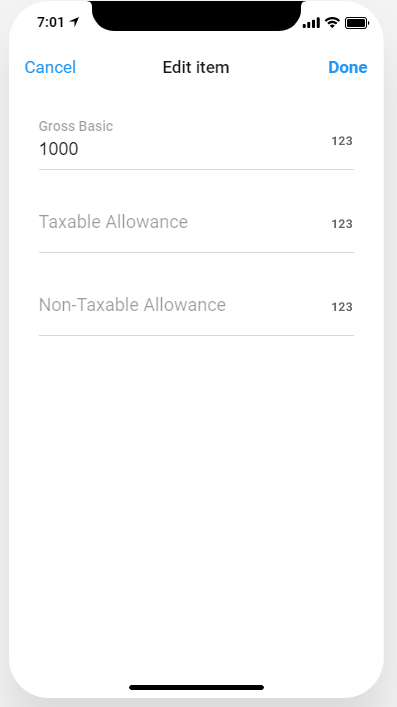

Lastly, when you want to make a change using your own figures, click on the Edit icon at the top right corner of the app and input your figures. After that click Done/Save. The App will generate the tax calculations for you.

There’s also a VAT calculator. You can try that one as well.

Let me know your experience and reviews in the comment box below.

Thank you.

built accountingGhana taxonline calculatorPAYEtax apptax calculatorVAT

[…] are supposed to be initially calculated on the VAT exclusive amount to arrive at the first set of taxes to add to the VAT-exclusive amount. After adding these two levies to arrive at a new sub-total, […]

[…] Read Also: How to install the tax calculator mobile app. […]