How to Link TIN to Ghana Card PIN

On the last day of March, the Registrar General’s Department (RGD) and the Ghana Revenue Authority both announced that effective…

Read Story

On the last day of March, the Registrar General’s Department (RGD) and the Ghana Revenue Authority both announced that effective…

Read Story

The Ghana Revenue Authority (GRA) has extended the deadlines for the filing and payment of annual taxes. This is part…

Read Story

There are two types of VAT systems in Ghana: the Standard scheme and the Flat rate. While the former comes…

Read Story

Last year, the government announced an 11% increment in the national daily minimum wage. By this, minimum wage earners who…

Read Story

Almost every year, the government increases the National Daily Minimum Wage (NDMW) to adjust to the prevailing costs of living…

Read Story

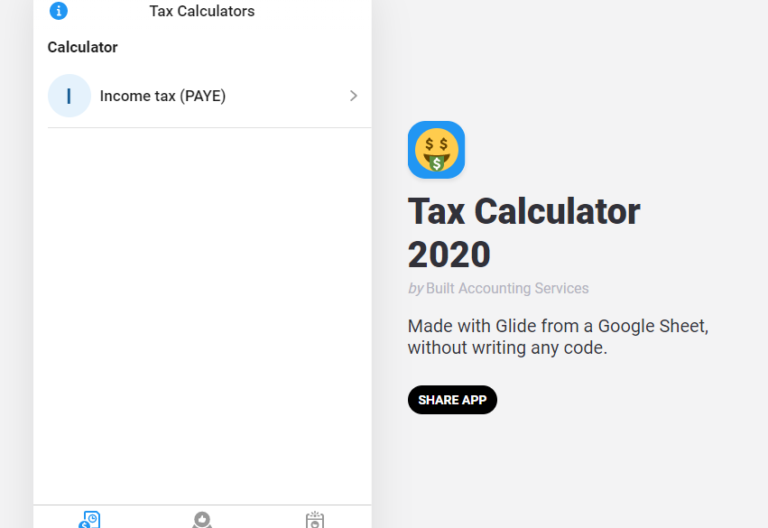

As business owners and accounting professionals we work with taxes on a daily basis. Finding a way to simplify how…

Read Story

Capital Allowance: is a practice of allowing a company to get tax relief on tangible capital expenditure by allowing it…

Read Story